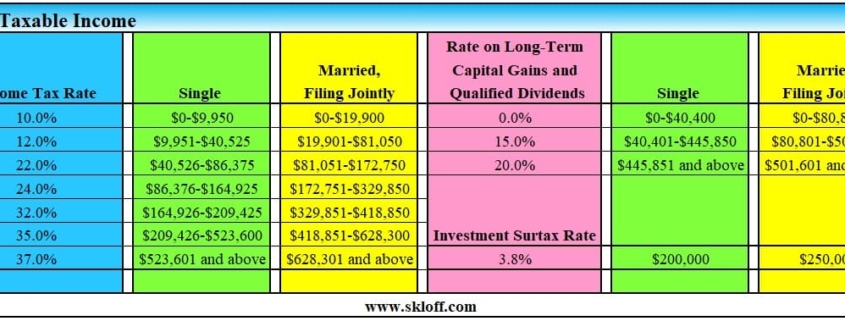

Capital Gains Tax 2021 | Potential capital gains tax problems and solutions to them. No changes from last year: It relies on the fact that money you lose on an investment can offset your capital gains on other investments. For the 2020 to 2021 tax year the allowance is £12,300, which leaves £300 to pay tax on. Capital gains tax rates and annual exempt amounts. It relies on the fact that money you lose on an investment can offset your capital gains on other investments. If you buy and sell investments, you need to know the capital gains basics or you are at risk of significant losses through bad tax planning, an irs audit. Quick and easy guide on capital gains. The tax law divides capital gains into two different classes determined by the calendar. Small business exclusion of capital gains for individuals (at least 55 years of age) of r1.8 million when a small business with a market value not exceeding r10 million is disposed of; Capital gains tax rates and annual exempt amounts. Here are the details on capital gains rates for the 2020 and 2021 tax years. Because the combined amount of £20,300 is less than £37,500 (the basic rate band for the 2020 to 2021 tax year), you pay capital. But you should be aware of a few rules and exceptions. 11 how to file taxes online in 3 simple steps how much you owe in capital gains largely depends on the tax bracket you fall into. The tax rates in the tables above apply to most assets, including most investments. The move means that entrepreneurs should find it easier to qualify for the capital gains tax entrepreneur relief, which gives a reduced rate of cgt of 10 per cent, compared with a normal rate of 33 per cent, on. Capital gains taxes are the taxes you pay on profits from most investments, including stocks, bonds, or mutual funds. You need to pay capital gains tax (cgt) when you profit from selling valuable assets such as shares, cryptocurrencies, art, or property. Here's what you need to know about the 2021 capital gains tax rates, as well as how you can minimize the money you pay the irs when selling profitable investments. An aspect of fiscal policy. Values shown do not include depreciation recapture taxes. Assets include shares of stock, a piece of land, jewelry, coin collections, or a business. 9 reporting capital gains and capital losses on your return. Find the capital gains tax rate for each state in 2020 and 2021. The tax rates in the tables above apply to most assets, including most investments. The move means that entrepreneurs should find it easier to qualify for the capital gains tax entrepreneur relief, which gives a reduced rate of cgt of 10 per cent, compared with a normal rate of 33 per cent, on. You need to pay capital gains tax (cgt) when you profit from selling valuable assets such as shares, cryptocurrencies, art, or property. Ak, fl, nv, nh, sd, tn, tx, wa, and wy have no state capital gains tax. Here's what you need to know about the 2021 capital gains tax rates, as well as how you can minimize the money you pay the irs when selling profitable investments. Potential capital gains tax problems and solutions to them. Find the capital gains tax rate for each state in 2020 and 2021. Assets include shares of stock, a piece of land, jewelry, coin collections, or a business. 11 how to file taxes online in 3 simple steps how much you owe in capital gains largely depends on the tax bracket you fall into. Capital gains tax rates and annual exempt amounts. The higher your income, the higher the. Small business exclusion of capital gains for individuals (at least 55 years of age) of r1.8 million when a small business with a market value not exceeding r10 million is disposed of; If you buy and sell investments, you need to know the capital gains basics or you are at risk of significant losses through bad tax planning, an irs audit. 10 do i have to pay capital gains tax this year? No changes from last year: The tax rates in the tables above apply to most assets, including most investments. If you sell stocks, mutual funds or other capital assets that you held for at least one year, any gain from the sale is taxed at either a 0%, 15% or 20% rate. A capital gain is what the tax law calls the profit you receive when you sell a capital asset, which is property such as stocks, bonds, mutual fund shares and real estate. An aspect of fiscal policy. Before you calculate your capital gains, you're going to need figure out something called the adjusted cost base. Potential capital gains tax problems and solutions to them. A capital gain rate of 15% applies if your taxable income is $80,000 or more but less than $441,450 for single; The capital gains tax calculator for 2021/22. It relies on the fact that money you lose on an investment can offset your capital gains on other investments. Ak, fl, nv, nh, sd, tn, tx, wa, and wy have no state capital gains tax. Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index, exemptions such income from capital gains is classified as short term capital gains and long term capital gains. The tax rate on most net capital gain is no higher than 15% for most individuals. The move means that entrepreneurs should find it easier to qualify for the capital gains tax entrepreneur relief, which gives a reduced rate of cgt of 10 per cent, compared with a normal rate of 33 per cent, on. 11 how to file taxes online in 3 simple steps how much you owe in capital gains largely depends on the tax bracket you fall into. Sunak did not mention any rises in capital gains tax itself (how much gains are taxed above the threshold) and neither does the 2021 budget. If you sell stocks, mutual funds or other capital assets that you held for at least one year, any gain from the sale is taxed at either a 0%, 15% or 20% rate. The 2020/2021 capital gains tax rates and taxpayer income levels, sorted by filing status. Capital gains rates for 2020 and 2021. All capital gains and losses are required to be reported on your tax return.

Learn more about options for deferring capital gains taxes capital gains tax. A capital gain rate of 15% applies if your taxable income is $80,000 or more but less than $441,450 for single;

Capital Gains Tax 2021: Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index, exemptions such income from capital gains is classified as short term capital gains and long term capital gains.

Source: Capital Gains Tax 2021

0 comments:

Post a Comment